The $FRMI Paradox

Not Your Momma's Manhattan Project.

The Fermi Paradox highlights the contradiction between the high probability of extraterrestrial civilizations existing in the universe and the complete lack of evidence or contact with them.” —conveniently for this conversation, Google’s AI Overview

A Semi-Brief Overview of Fermi America

Let’s start simple - what is Fermi America?

Fermi America (aka Fermi Inc./Fermi LLC), simply put, is as an energy and hyper-scaler development company built for the increasing AI energy consumption demand. The company was incorporated in early 2025 and is co-founded by Rick Perry (former DWTS season 23 contestant) and Toby Neugebauer (founder of anti-woke bank that ultimately went broke). Fermi America was founded on July 4th, deep in the heart of Texas. Very patriotic.

This is what Fermi America plans to do:

[Answer] President Donald J. Trump’s call to deliver global energy and AI dominance with the Project Matador campus, with plans to include safe, clean, new nuclear power, the nation’s biggest combined-cycle natural gas project, utility grid power, solar power, and battery energy storage at unprecedented scale”.

Or as they like to call all that with one word:

The unprecedented scale they refer to? 11 GW of power, with 1 GW up-and-running by end of 2026, a feat that many experts claim is nearly impossible due to regulatory hurdles and lack of cashflow to fund this massive construction project. For context, the Hoover Dam generates 2 GW of power. Which leads me to their stock…

As of October, Fermi America is a publicly traded pre-revenue company under the ticker: FRMI 0.00%↑. Since going public, the company has experienced about a -65% decline, tumbling from the IPO price of $21/share to roughly $7.00/share at the low. A steep decline largely attributed to the termination of an AICA (Advance in Aid of Construction Agreement) by their first prospective tenant and also the market’s volatile sentiment towards AI. It’s important to note that Fermi is categorized as a REIT, which explains why this termination was detrimental to their stock price.

What does the above mean? Basically, a tenant said they would provide Fermi with 150 million dollars to help develop the energy campus, but upon finalizing the deal backed out, meaning this REIT has ZERO tenants and a big vision. Fermi has cited that they are re-negotiating the contract terms, but unfortunately the damage has been done and has left many retail investors skeptical, with some law firms even preparing litigation for “misleading investors”. To be clear, we don’t know who backed out of the deal. There is some speculation online that suspects it was Amazon, but again, there is no official confirmation of who so I personally don’t feel misled… business isn’t always a straight line.

TLDR: Fermi is a newly-formed company trying to raise cash to fund the construction of their highly ambitious “Project Matador” HyperGrid. They want to lease parts of the campus to large corporations seeking private energy since the current method is to use the public energy grid, which in turn adds additional load to already antiquated technology. Fermi America the solution to that problem.

But to understand how Fermi is uniquely positioned we have to talk about the people behind the company. Let’s start with the obvious players, Rick Perry and Toby Neugebauer, and then move down the list of people to explore whether this ambitious plan is impossible or if we’re over-looking details under the hood that tell a much different, optimistic story.

The Founders of Fermi

Rick Perry:

Texas Governor (2000-2015) - longest-serving in state history

Dancing With The Stars Contestant (2016) - finished 12th out of 13 contestants

U.S. Energy Secretary (2017-2019) under Trump’s first administration

Co-Founder of Fermi America (2025)

Toby Neugebauer:

Son of Texas politician Randy Neugebauer, major donor to Rick Perry and Ted Cruz, and “smaller” donor to Donald Trump

Co-Founder, Windrock Capital/Windrock Energy (1994-1998)

Co-Managing Partner, Quantum Energy Partners (1998-present)

Built one of America’s most successful private equity firms

Founder & CEO, GloriFi/With Purpose Inc. (2021-2023)

Notable investors included: Peter Thiel, Ken Griffin, Vivek Ramaswamy (nightmare blunt rotation)

Valued at 1.7 billion before collapsing and filing Chapter 7 bankruptcy

If you’re reading this and you know anything about the intersection of the above people, politics, and business, your alarm bells are probably ringing, and rightfully so. There is 100% a political-identity angle to this, evident with the founder’s and executive leadership’s connections. To put it bluntly, they’re all in on MAGA.

The executive leadership team comprises of Larry Kellerman, Mesut Uzman, Griffin Perry (we will come back to him), Miles Everson, Jacobo Ortiz, Charlie Hamilton, Sezin Uzman, and Cathy Landtroop. You can see their specific roles on Fermi’s website, but to save you the time, it’s a roster full of highly experienced individuals with proven track records across nuclear energy, construction, and venture capital/wealth management. Cathy Landtroop sticks out in particular with her Super PAC connections (also, does anyone else think she looks like Jennifer Aniston?).

But of all the people involved in and around Fermi (that I’ve found), there are three individuals that piqued my interest, and more importantly, made me think that this entire project is in fact a reality and not just AI renderings.

The Builder, The Liaison, and The Koreans

The Builder aka Stefan Kasan.

Stefan Kasan is the AI Data Center Leader for Fermi America.

He has 21 years of comprehensive construction experience, 12 years of which is in data center construction. But who has he worked for that made this seemingly ordinary job suddenly not so ordinary? Well, Stefan was the manager of campus construction for Meta Platforms, where he played a vital role in the construction of the data centers in Nebraska.

This fills a critical gap in the executive leadership team’s experience, which is constructing data centers. His experience, along with a few others (like Dannie Weaver), will help create the diversified and all-encompassing campus that separates it from other data centers and energy campuses.

But before ground could even break, someone had to quell a growing Amarillo community’s concern for their safety and water rights. Cue, the Liaison.

The Liaison aka Trent Sisemore.

Trent Sisemore is the Community Lead for Fermi America.

In other words, he acts as the liaison between the community of Amarillo and Fermi executives. He was hired directly by Rick Perry as an independent consultant, is the former mayor of Amarillo from 2001-2005, and is a 4th generation Amarillo resident. During his term as mayor, he notably purchased water rights for the next 300 years for the city of Amarillo, built the Amarillo Civic Center, and brought Bell Helicopter’s V-22 assembly operations to Amarillo.

“Okay….” you might be thinking, “Who cares about this guy? Another politician making promises, we’ve heard this story before.”

I suggest you watch the following interview (and apologies in advance for the red wave imagery), but this under-the-radar interview is packed with nuggets of information, straight from the (ex-)mayor’s mouth:

Below are some of the gems in case you don’t have 30 minutes to watch two cowboys discuss AI data centers:

06:00 - Trent paraphrasing Rick Perry: “This company has to do with national defense.”

08:05 - Trent: “China has built 30 nuclear reactors since we built our last one.”

09:30 - Trent: “They’re building 15 million square feet of buildings, that they then will lease out to these mega… people... I-I can’t, you’d know all seven of ‘em if I mentioned them, but I wanna be careful because some of them we’re in negotiations”.

17:00 - Trent: “They have the number one nuclear scientist in the world working for them, [he’s] built the last 12 nuclear reactors.”

17:40 - Interviewer: “This is going to be another Dept. of Defense”

18:00 - Trent: “I have to be careful when I say it’s the Dept. of Defense, I-I just, I… there’s some things I can’t—I can’t say. You said that, I didn’t… I will say this, Secretary of Energy has Fermi’s plans on his wall”.

18:30 - Trent: “Fermi traded some land with PANTEX, it went through 28 regulatory agencies which should take 6 years probably with the federal government, they got everybody in one room and it took 45 days.”

While maybe a seemingly casual interview between two Texans, the implications of clues Trent drops, whether they were intentional or not, tell a lot about what is going on behind the scenes.

He hints at potential Department of Defense contracts (Starlink and Palantir come to mind), seven corporations “we all know” (*cough* Mag 7 *cough*) with negotiations on-going, and he even mentions how Fermi’s team is able to expedite the regulatory process that usually moves at a snail’s pace. So you would think that any company in an AI race would want to invest in not just an energy facility, but the one with the ability to pull strings to their competitive advantage. Free markets, baby.

Of course, it’s all speculation, but if you read between the lines you start to see where the cracks are getting filled in by big corporations, which brings me to third part of this triad.

The Koreans ie Cantor Fitzgerald:

Cantor Fitzgerald are the lead underwriters for Fermi’s IPO. They are a premier global financial services firm and investment bank, founded in 1945.

The current U.S. Secretary of Commerce is Howard Lutnick, who before accepting this role, was the CEO of Cantor Fitzgerald. This has brought major scrutiny to all Cantor Fitzgerald related dealings as many cite it as a conflict of interest, which I don’t necessarily disagree with. I do have a feeling that the argument to be made in favor of Cantor Fitzgerald is that Fermi America has more to do with national defense than energy, hence the complete disregard for what normally would be a more deeply scrutinized IPO “scandal”.

Lutnick has so far negotiated a trade agreement with South Korea worth 350b, which brokered a deal with Doosan Enerbility (S. Korea’s largest nuclear component supplier) into a partnership with Fermi for Project Matador. While the partnership has been inked, fund allocation to these partners has not been announced… after all, Fermi doesn’t really have any money, or contracts, or tenants. Basically, Doosan and others are committed to building for Fermi, they just need an advance first. But the question then becomes, who is paying them?

What we know through the above is that Fermi America’s core partners for building its 11GW site are all Korean:

Reactors: Doosan Enerbility (AP1000 core parts)

Construction: Hyundai E&C, Samsung C&T

Grid/Transformers: HD Hyundai Electric, LS Electric

We also know that Korea has pledged to invest in US nuclear infrastructure with a 50/50 profit split deal.

The American government then designates what companies, like Fermi America, receive this funding from South Korea.

Fermi then pays it’s Korean partners using their own government’s money.

This positions Fermi America perfectly - Korea pledges money, Korean companies then build Fermi using Korea’s money, Korea takes 50% of all earnings, US energy infrastructure is improved, both countries citizens are happy, everyone is making money and advancing technology, and it’s a massive win for all parties involved.

"Having worked with Doosan for many years, I have seen firsthand their unmatched expertise and ability to deliver on complex projects. I have complete trust in their capability to help us realize our vision at Fermi America," said Mesut Uzman, Chief Nuclear Commercial Officer of Fermi America, in a PR Newswire article

Leading Bulls to Slaughter?

Project Matador is Fermi America’s flagship development at an approximately 11-gigawatt behind-the-meter energy generation and data center campus in Amarillo, Texas, on land owned by Texas Tech University. The plan includes powering data centers with a combination of nuclear, natural gas, and solar energy.

According to some sources, the timeline of completion could range from 15 to 20 years, conservatively. That being said, Fermi leadership and other representatives are adamant they will have 1 GW of power online by the end of 2026.

Fermi America social media has posted photos of developments, the most recent being about the arrival of natural gas turbines. Some users online have mentioned that securing these turbines in the time they did is unusual, a possible reflection of the political ties giving them a critical advantage in building out American energy infrastructure. They have also posted cleared land, fences being built, and large concrete support beams dug into the ground.

I will admit that I am a bit superstitious, and the metaphor of a matador tricking a bull (me) into slaughter does live in the back of my mind. It also doesn’t help that they have used AI way too much in their hype videos posted across socials channels.

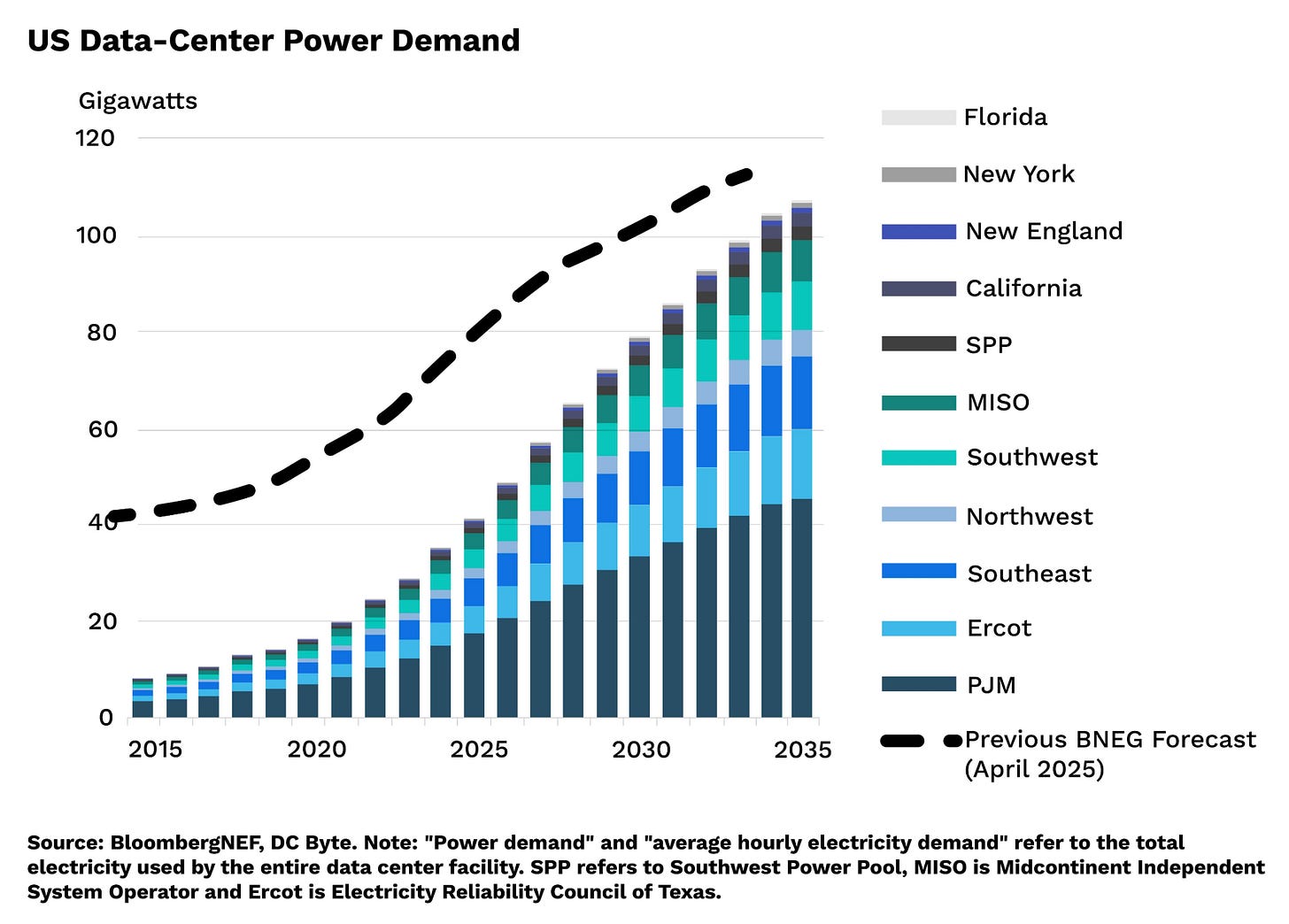

Ultimately, what brings me back to the possibility of Project Matador coming to fruition is the promise to deliver on demand coupled with the concept that this is a strategically defensive move to help America succeed in the AI race. Below is a chart from Fermi America that depicts US data-center power demand exceeding 100 GW of power by 2035, which as of now would rely heavily on public grids.

“The U.S. must possess a power source akin to a ‘nuclear arsenal of power generation,’” [while revealing] plans to construct multibillion-dollar nuclear facilities funded by Japan and South Korea. - Howard Lutnick, U.S. Secretary of Commerce

Legacy Building or Generational Fleecing?

If you’ve stuck with me to this point I assume you’re an interested investor, and if you’re going to hold FRMI 0.00%↑ you better get used to the color of your knuckles being white.

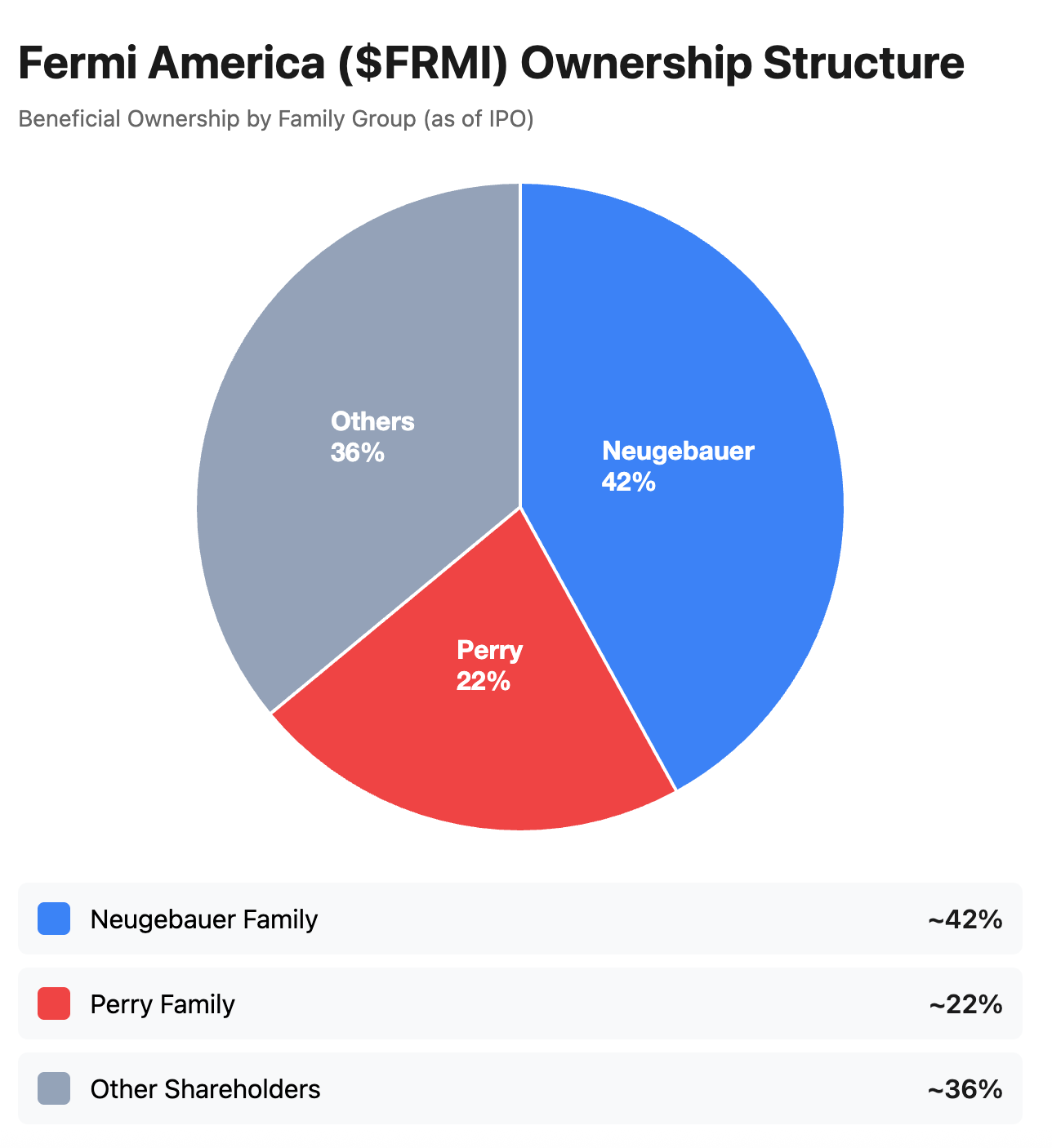

Below is a very simple pie chart reflecting Fermi America’s ownership structure, or in other words, the amount of shares that are owned between the founders vs everyone else.

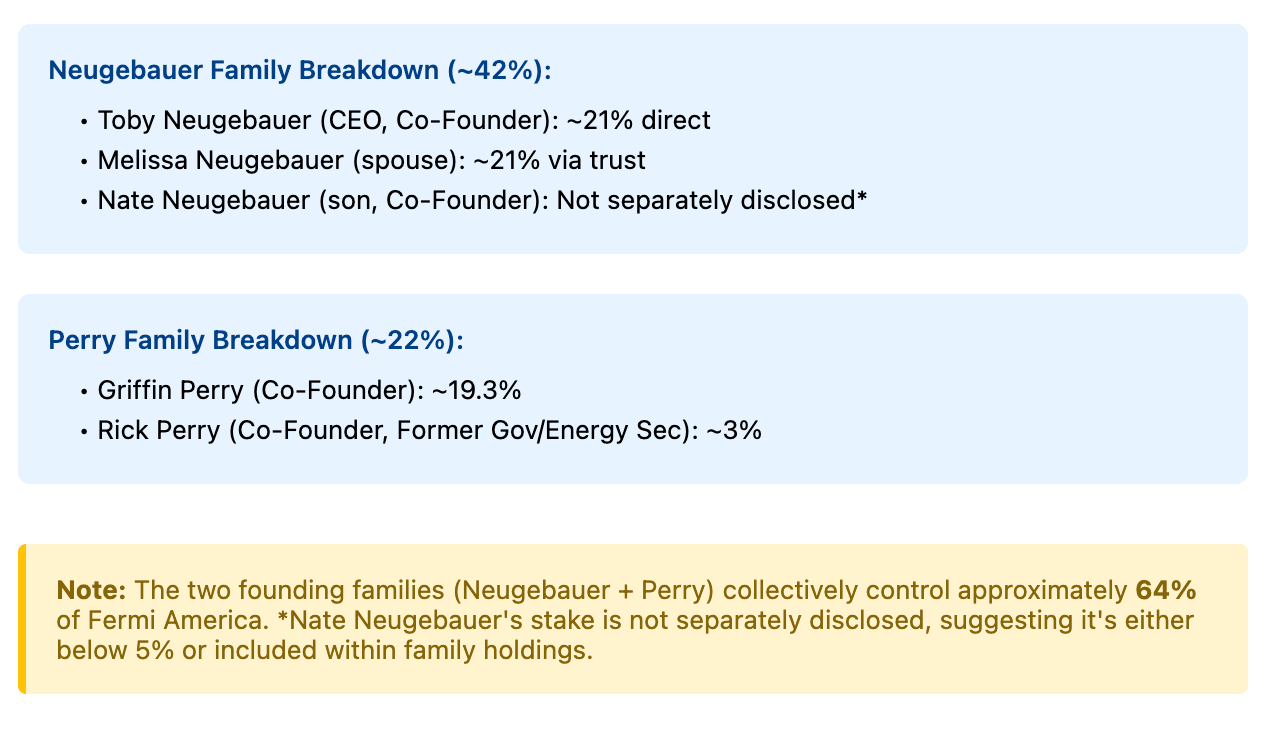

I conveniently left out Nathan Neugebauer (Toby’s son) and Griffin Perry (Rick’s son) until we got to this section because, well, it’s alarming to see the stake that they’re given. Griffin has a fairly robust resume and seems qualified (which is probably why his 19.3% ownership is given directly to him), but where it gets very uncomfortable is the Neugebauer side of the story.

I take no issue with Toby having 21% ownership considering he founded the company, and I actually think it’s a net-positive when the power is concentrated to founders. I do take issue with another 21% going into a family trust (which is possibly where Nathan’s stake is bundled into, but there is no way to verify on my end). This trust is seemingly divided up between Toby’s wife, Toby’s father, and his son. Between those three people, I personally believe there is zero qualifications to warrant the percentage given. If anything, it seems like it could be an opportunity for one party (whether Toby or the trust) to unwind their position in the short-term while maintaining a large enough stake for long-term control coupled with the trust; effectively, a win-win situation with hardly any negative downside.

I have two call-outs with this.

First, is that I asked you in the beginning of this piece to note that Fermi America is categorized as a REIT - a Real Estate Investment Trust. With this REIT, there is something called a “2.5% Ownership Rule”, which effectively means that no one can own more than 2.5% of value. The usual standard is closer to 10%. This tightened requirement is to prevent "closely held" status, and is designed to prevent new large investors from accumulating big stakes and gain influence. In the case of Fermi America, there was an exception that allows the board of directors to grant waivers for people or entities to accumulate more than 2.5%. Obviously, there have been several granted waivers…

My second call-out has to do with the “Lock-up Expiration Date” on March 30, 2026.

What this means is that upon that date, both the Perry and Neugebauer families could theoretically begin selling their shares. The question, to me, is whether they see Fermi America as a legitimate means to becoming generationally ultra-wealthy (ie becoming the modern version of oil barons via an energy campus) or if they see this lock-up period as their window to cash in on smoke and mirrors (in this case chain-link fences, water pipes, and AI tractors). Let me explain how slippery this slope could get and why it’s worth paying attention to when investing in this company, especially over the next few weeks.

Currently, the actual “float” available to trade on the market is a measly 32.5 million shares that were sold in the IPO.

560 million of the 592.5 million are locked up. This means that the available float is roughly 5%. For context, what is considered to be typical/healthy floats is between 10-25%. This means that the Average Joe currently has access to only 5% of all shares of Fermi America.

95% of all shares are locked up and can be sold on March 30th. Of the 560 million shares locked up, the Perry and Neugebauer have 379 million shares, or 68% of locked up shares.

We can safely assume that most shares given to the families were in the range of $2 to $8/share. So if the stock is above their cost basis come March 30th, both families stand to make hundreds of millions before ever delivering on a single promise.

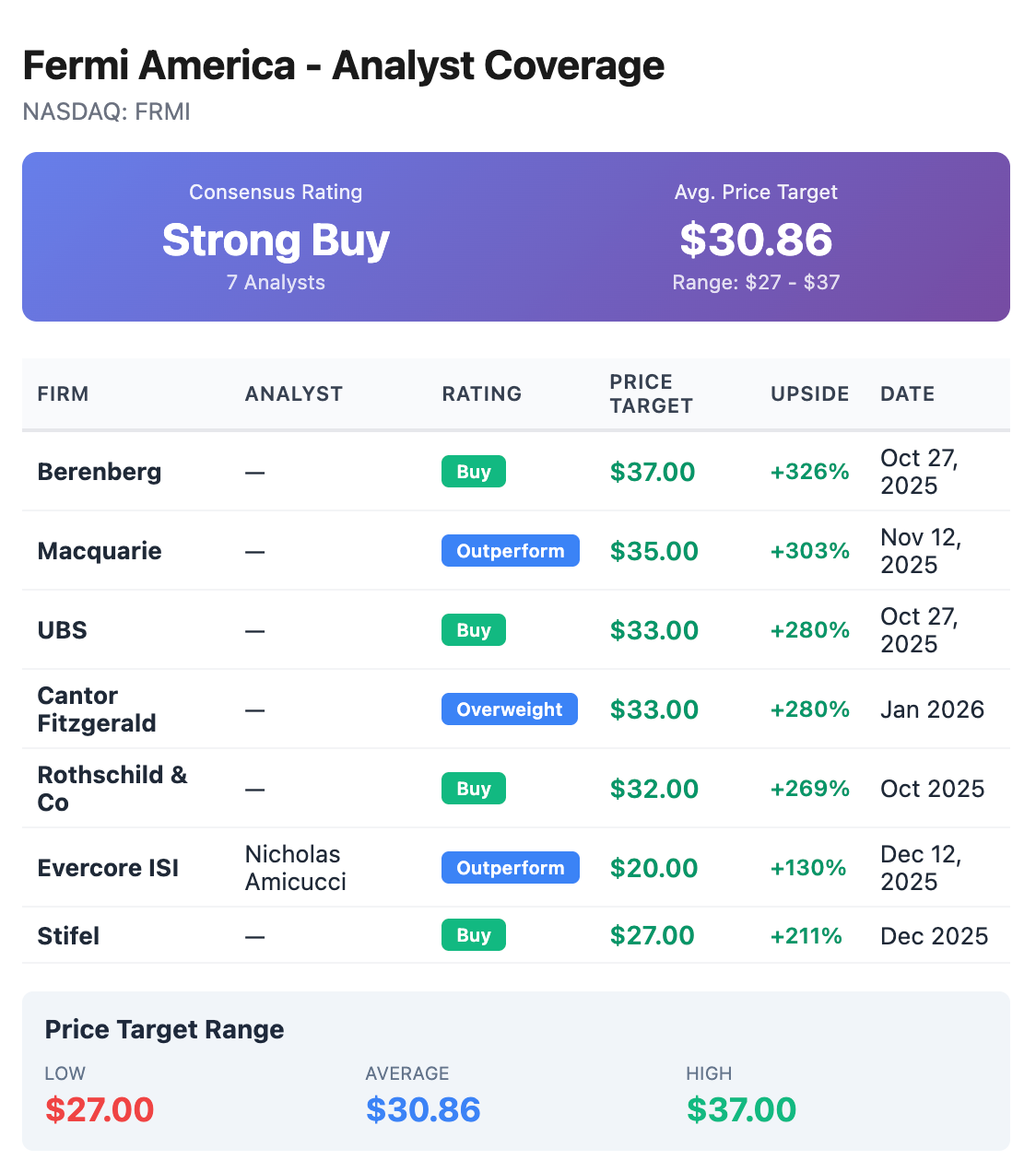

The float could hypothetically increase from 5% to nearly 100% overnight if insiders choose to sell, which would represent a ~17x increase in available shares. Now do I expect them to sell all their shares? Absolutely not, gun to my head, I wouldn’t even expect them to sell 20%.. The reality is that they will deliver on some of this promise no matter what, and that has tangible real value for investors. Here is what 7 analyst covering Fermi also think:

But do I think there is a real possibility that all entities involved have scheduled sells, essentially scaling a portion out and securing the bag? Yes, and this is what any reasonable person would do when looking at profits to the tune of tens/hundreds of millions.

Undoubtedly, there is going to be some selling on the the lock-up expiry date - but the question that beckons is whether people will be lined up to buy, if there is an avalanche of selling on the horizon, or if the founders themselves don’t sell themselves short. I think the answer will be found in the price of the stock as we near the lock-up expiration, but I am leaning heavily towards the latter.

Wall Street - Greed or Legacy?

Piggy-backing off of the above, I lastly want to explore option activity on FRMI 0.00%↑ and the underlying narrative that might be unfolding. For those who don’t know the significance of options, they can be cost-effective tools to quickly compound gains with short-term moves, whether it’s a directional bet or a more traditional hedge against a long position. I recommend just buying shares, but options can be indicators of near-term catalysts.

We know through various resources that Fermi America is in negotiations with multiple companies as they search for their first anchor tenant. We also know that two families control a large portion of locked-up shares that they can sell on March 30th, or in about 7 weeks. Meaning at the moment, the float is extremely minuscule and can be pulled both ways very easily if a catalyst is announced. We were originally told by Fermi management that a deal would be announced by end of 2025, specifically by Christmas, but as you can deduce Santa never came to town.

There is also pledged Korean investment, and using the dots we connected earlier, it’s highly plausible that a large American company is circling a deal Fermi.

So let’s take a look at some option activity and see the bets that I think are being placed, which I think are almost certainly aligning with potential announcement windows. Over the last weeks, there has been unusual option activity on the February 20th, 2026 and March 20th, 2026 call expiries at the $10 and $20 strikes.

As you can see by this 1.7 million dollar bullish spread, the buyer assumes the price to increase by February 20th. This spread was purchased on January 12th, meaning the purchaser isn’t doing so hot at the moment with stock’s decline. To me, given that the open interest (the amount of contracts purchased that haven’t been closed out for a gain/loss) has only INCREASED since this purchase, demonstrates that someone is NOT unwinding their bet but are throwing more chips on the table and saying “thanks for the deal”. Devil’s advocate: they could also be a chasing idiot.

But coincidentally enough, Fermi’s earnings report is also slated to be released on 2/17 in pre-market. Place your bets accordingly, and if you want to play it conservatively, the March 20th strikes are also lit up like a Christmas tree. While this positioning could be a secondary, safer bet to the above play, it still expires before the lock-up expiry date working in favor of Fermi’s small float awaiting a catalyst.

So what do I think could happen?

Well, if I was sitting on locked-up shares like a few individuals, my hope would be that $FRMI’s price on March 30th is as high as it can be (how about that analyst average), or at the very least, back to the IPO price of $21. With a minuscule float, all it takes is one catalyst to send this flying, and given the brewing speculation of a major first tenant, this could be flooded with traders looking to get in after an announcement. If I’m on Fermi America’s leadership team, I am frantically working to make this happen, but as someone who is just an investor I see it as an opportunity to be first.

And if all that still doesn’t make sense to you, here’s Gordon Gekko to explain why I think Fermi management will do everything in their power to have a deal finalized by end of quarter:

In Conclusion

After researching to the best of my abilities, I find that Fermi America is a uniquely positioned company in the REIT, energy, and data center space. To my knowledge, it’s the only company promising to weave those three sectors together.

With it’s strong political connections, both federal and state level, and foreign investment, Fermi America is setting up to be a generational company that could be America’s north star for re-shaping how we generate and view energy, especially against the creeping back-drop of our aged energy grids.

As of writing this article, I have a position in FRMI 0.00%↑. I also wanted to share this Politico article that I found to be very informative after writing most of this piece; they honestly do a better job than me, I just committed a lot of time to this and wasn’t willing to throw away my thoughts, so thank you for sticking around. In that article, you will also see Toby Neugebauer wearing the Post Malone x Ugg collaboration boots.

While completely irrelevant to any sort of investing thesis, I also own a pair of Post Malone x Ugg’s boots.

Sometimes the universe sends you signals, follow them.